newhandle

03-06 11:48 PM

bump. How should I approach my AOS given my case above?

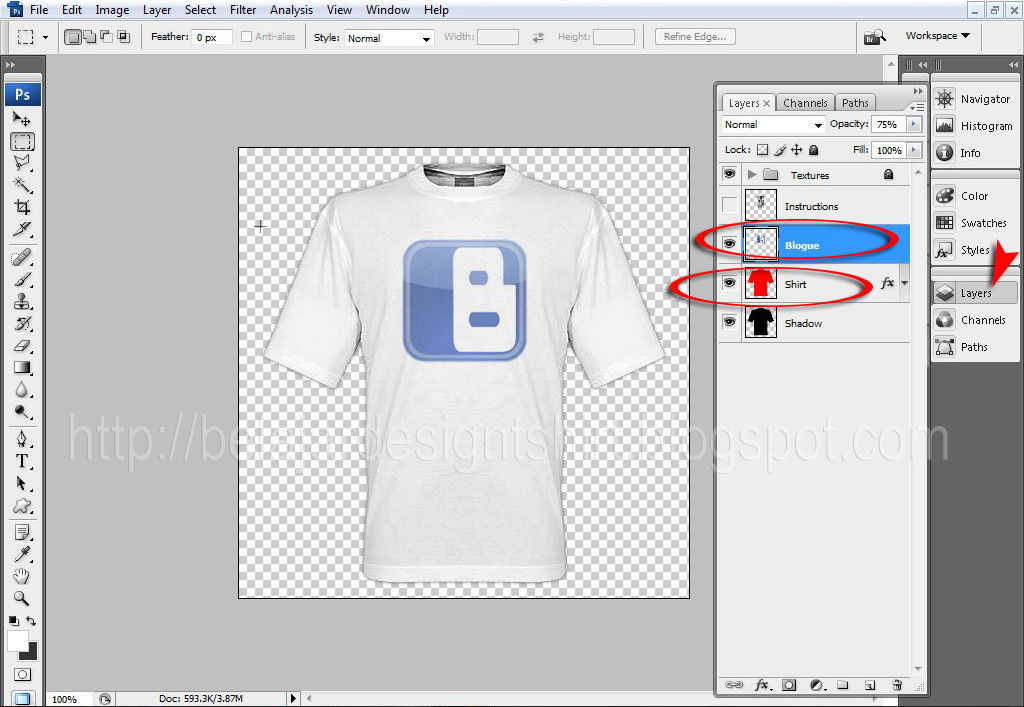

wallpaper lank t-shirt templates

nareshg

12-16 06:17 PM

They might be sending second FP notice every 15mnths of first/consecutive FP's done once it expires in their system..wait for that notice and dont worry about it now..

Thanks all for your replies...perhaps my question is not clear...I would have posted a new thread but was not easily able to figure out how to do so...

Will try to ask my question again...

I am not worried about when my FP expires and things on those lines....

my questions is for jobs that require green card or citizenship... there are some federal jobs out there that require security clearance....and for which they need either green card holders or citizen I beleive...

Now if one has an EAD (no green card yet, 485 pending for more than 1 year) and has got his/her FP done in FEB 2008 what does that mean...does it mean that once you have your FP done there is some kind of security clearance that you get from FBI ?...can you say you have active security clearance..if so what kind of security clearance is that called ?...as I said when I went for the Biometrics/FP (Code 3) they stamped the notice with the following

Biometrics Processing Stamp

ASC Side Code: __________XTE<location>

Biometrics QA Review by ________ (officer's signature)

Tenprints QA Reivew (officer's signature)

Thanks Gurus !!

Thanks all for your replies...perhaps my question is not clear...I would have posted a new thread but was not easily able to figure out how to do so...

Will try to ask my question again...

I am not worried about when my FP expires and things on those lines....

my questions is for jobs that require green card or citizenship... there are some federal jobs out there that require security clearance....and for which they need either green card holders or citizen I beleive...

Now if one has an EAD (no green card yet, 485 pending for more than 1 year) and has got his/her FP done in FEB 2008 what does that mean...does it mean that once you have your FP done there is some kind of security clearance that you get from FBI ?...can you say you have active security clearance..if so what kind of security clearance is that called ?...as I said when I went for the Biometrics/FP (Code 3) they stamped the notice with the following

Biometrics Processing Stamp

ASC Side Code: __________XTE<location>

Biometrics QA Review by ________ (officer's signature)

Tenprints QA Reivew (officer's signature)

Thanks Gurus !!

xyz2005

08-06 04:53 PM

Friends, I Received the magic email today!

Yes - I cant believe my eyes, my I-485 has been approved today and card production ordered.

I do have a question: I could not file for my wife's i-485 in July/2007. So, we filed for my wife's application on Aug/01/2008 (Did a overnight express mail on July-31st) as my PD is current as of Aug-1st. So far her application check has not been deposited.

What will happen now? Is she out of status? I am getting really concerned. Gurus help me out?

Thanks in advance.

A green dot guaranteed for the response :)

Some details:

I-485 Receipt Date: July/2/2007

I-140 Approval Date: July/3/2006

PD: 02/02/2006

Heartiest congrats

Your wife is not out of status...you have applied and her official status is 485 applied and status pending. Keep her FedEx receipt handy till you get her official receipt. Dont worry its just 6 days past when you sent her application and there is a huge rush. You will get it soon and check would be encashed soon as well. My experience it takes time to get cash encashment particularly when there is a huge rush.

Take care and accept our heartiest congrats once again.

Best Regards,

Yes - I cant believe my eyes, my I-485 has been approved today and card production ordered.

I do have a question: I could not file for my wife's i-485 in July/2007. So, we filed for my wife's application on Aug/01/2008 (Did a overnight express mail on July-31st) as my PD is current as of Aug-1st. So far her application check has not been deposited.

What will happen now? Is she out of status? I am getting really concerned. Gurus help me out?

Thanks in advance.

A green dot guaranteed for the response :)

Some details:

I-485 Receipt Date: July/2/2007

I-140 Approval Date: July/3/2006

PD: 02/02/2006

Heartiest congrats

Your wife is not out of status...you have applied and her official status is 485 applied and status pending. Keep her FedEx receipt handy till you get her official receipt. Dont worry its just 6 days past when you sent her application and there is a huge rush. You will get it soon and check would be encashed soon as well. My experience it takes time to get cash encashment particularly when there is a huge rush.

Take care and accept our heartiest congrats once again.

Best Regards,

2011 T-shirt Template (man and

samcam

05-19 10:57 AM

Welcome to our newest member TheHumanist

3869 and counting!!!

3869 and counting!!!

more...

santosh08872

12-02 10:06 PM

Thanks for sharing the great news, I am going to join on EAD for new job and at least one thing less to think about.

iwantmygcnow

11-09 10:22 AM

This is exactly what happened to my case. My attorney sent the porting request three time with no success. He says USCIS is returning the request without giving any reason.

more...

xgoogle

06-23 09:08 AM

I had applied under EB-2 category and my priority date is: 3/3/2006.

My I-485 was filed on 8/2/2007.

My I-485 was approved and I received my Green Card on Aug 15th 2008. Surprisingly and rather unfortunately, there was no action on my wife's I-485. My wife�s case was submitted with my own case on 8/2/07. The TSC at that time reported that �normal� processing time is 7/16/2007. So basically I got mine out of turn or by chance. The TSC protocol permits attorneys to inquire regarding the status of an I-485 beyond normal processing time if the receipt date is more than 30 days beyond the published processing date. So we could not inquire about my wife's application and soon the priority date changed back.

She has an EAD approved until Oct 2010. She is currently employed. I am also employed with my first company and have been with them for 5 yrs now.

My questions are:

1. What happens to my wife's I-485 application, should I choose to leave my job and go back to school ?

2. Will her EAD still be valid if I leave my job ?

2. I am planning to go full-time starting Fall 2010. Will we be able to renew her EAD independent of my work status ?

Thanks a lot for your time and attention,

My I-485 was filed on 8/2/2007.

My I-485 was approved and I received my Green Card on Aug 15th 2008. Surprisingly and rather unfortunately, there was no action on my wife's I-485. My wife�s case was submitted with my own case on 8/2/07. The TSC at that time reported that �normal� processing time is 7/16/2007. So basically I got mine out of turn or by chance. The TSC protocol permits attorneys to inquire regarding the status of an I-485 beyond normal processing time if the receipt date is more than 30 days beyond the published processing date. So we could not inquire about my wife's application and soon the priority date changed back.

She has an EAD approved until Oct 2010. She is currently employed. I am also employed with my first company and have been with them for 5 yrs now.

My questions are:

1. What happens to my wife's I-485 application, should I choose to leave my job and go back to school ?

2. Will her EAD still be valid if I leave my job ?

2. I am planning to go full-time starting Fall 2010. Will we be able to renew her EAD independent of my work status ?

Thanks a lot for your time and attention,

2010 girlfriend lank white t shirt

Rb_newsletter

09-03 10:16 PM

Anybody who works for consulting co. got extension approved ? without RFE ?

In one of my friend's case they approved H1 for 6 months, because he had contract only for 6 months. He just completed 3 years and this is his first extension request. :eek: Who the hell in this world writes contract for more than 6 months even if they have requirements for next 2 years.

Another case I heard was immigration officer at POE granted only 1 year I-94 even though he had 2 years left in his visa. It seems IO spoke to candidates manager and advised him to hire someone locally and get him trained within a year.

Are we in real United States of America? So much of hate around.

In one of my friend's case they approved H1 for 6 months, because he had contract only for 6 months. He just completed 3 years and this is his first extension request. :eek: Who the hell in this world writes contract for more than 6 months even if they have requirements for next 2 years.

Another case I heard was immigration officer at POE granted only 1 year I-94 even though he had 2 years left in his visa. It seems IO spoke to candidates manager and advised him to hire someone locally and get him trained within a year.

Are we in real United States of America? So much of hate around.

more...

Znan

07-15 11:03 AM

I understand your concern; however the USCIS now has concurrent filing which means that I-485 applications and I-140 applications can be filed at the same time. The USCIS will work on your case if the priority date is current even if the I-140 is not yet approved. They will simply adjudicate the I-140 at the same time they adjudicate the I-485.

The Amended I-140 was necessary to notify the USCIS of our name change. The Amended I-140 will ultimately need to be approved before your AOS application can be approved, however with concurrent filing what often ends up happening is the I-140 and I-485 are adjudicated at the same time.

Guys:

My case is different. I have 140 approved during jan2006. PD- 11/2005 EB2,

Again. Amendment 140 filed (((on 07/02/07 (RD) and 08/30/07 (ND) at TSC)) by the new company, which tookover our earlier company (New co.Much bigger in size).

Now, I have original 140 approved, and Amendment still pending. PD is current, just waiting to see how it would imapact. :confused:

Any advise from Seniors/ Gurus.. :)

Thanks in Advance

The Amended I-140 was necessary to notify the USCIS of our name change. The Amended I-140 will ultimately need to be approved before your AOS application can be approved, however with concurrent filing what often ends up happening is the I-140 and I-485 are adjudicated at the same time.

Guys:

My case is different. I have 140 approved during jan2006. PD- 11/2005 EB2,

Again. Amendment 140 filed (((on 07/02/07 (RD) and 08/30/07 (ND) at TSC)) by the new company, which tookover our earlier company (New co.Much bigger in size).

Now, I have original 140 approved, and Amendment still pending. PD is current, just waiting to see how it would imapact. :confused:

Any advise from Seniors/ Gurus.. :)

Thanks in Advance

hair hot Cool white t-shirt

tnite

09-12 11:33 AM

Mine was delivered at 9.02 am July 2nd and signed by R.Mickels .

Checks havent been cashed.no receipts

Checks havent been cashed.no receipts

more...

vishage

09-05 04:41 PM

She checked my file over 20 minutes and also talked to her supervisor. they thought USCIS maybe lost my application somewhere. right now, I am waiting response from NSC for my application. I really do not know what need to do.

wish I am the only bad luck one here and good luck to everyone.

Thanks Divakrr,

Tried this the lady on the second level said she couldnt find anything on the file yet.gues have to keep waitin

wish I am the only bad luck one here and good luck to everyone.

Thanks Divakrr,

Tried this the lady on the second level said she couldnt find anything on the file yet.gues have to keep waitin

hot hairstyles Template blank

ambals03

03-10 04:54 PM

I transfered last week, I got msg saying it has been remitted today. No issues.

more...

house hair T-shirt design template set lank t shirt design template. hairstyles

gcgonewild

08-15 02:16 PM

Unless:

i) Has company A paid you all your wages?

If there is a window when you were not paid, they wouldn't even think about suing you.Become a whistle blower, Complain to the DOL if you were not paid prevailing wages.

ii) Content of Non-Compete agreement:

If the Non-Compete agreement is overly restraining, it is not valid. Check the statements. If it says more than 2 years, and no geographical limits, it is not valid. Does it say you cannot join B or you cannot join any end-client ?

iv) LCA for new work location:

If you work for more than 6 months in a county, new LCA should be applied for that location.

Try to negotiate with A. Usually these lawsuits don't run their course.

Attorney fees are: minimum 2k just for consultation. 5k if A comes to negotiation after lawsuit. 10-15k if it goes to trial. So instead of paying the attorney , you could pay A and get away.

If all fails, You MUST consult an attorney.

IMHO, you should've consulted before you took the job.

i) Has company A paid you all your wages?

If there is a window when you were not paid, they wouldn't even think about suing you.Become a whistle blower, Complain to the DOL if you were not paid prevailing wages.

ii) Content of Non-Compete agreement:

If the Non-Compete agreement is overly restraining, it is not valid. Check the statements. If it says more than 2 years, and no geographical limits, it is not valid. Does it say you cannot join B or you cannot join any end-client ?

iv) LCA for new work location:

If you work for more than 6 months in a county, new LCA should be applied for that location.

Try to negotiate with A. Usually these lawsuits don't run their course.

Attorney fees are: minimum 2k just for consultation. 5k if A comes to negotiation after lawsuit. 10-15k if it goes to trial. So instead of paying the attorney , you could pay A and get away.

If all fails, You MUST consult an attorney.

IMHO, you should've consulted before you took the job.

tattoo T Shirt Templates : Free and

goosetavo

11-13 05:43 PM

I'm trying to figure out the reasoning behind Mexico's numbers as well. According to the latest cut-off date tables http://www.travel.state.gov/pdf/EmploymentDemandUsedForCutOffDates.pdf

Mexico has about 5,800 folks total for EB-3 in the queue so far, but we have seen very little movement in the past years. My questions to the forum:

1) Is the slow movement due to so many cases in field offices not yet reported?

2) Do family-based numbers take away from the 7% of 140K visas a year or are these solely for EB?

3) Any idea why movement is so slow for Mexico given the numbers of people currently in the queue?

Theories are welcome.

Mexico has about 5,800 folks total for EB-3 in the queue so far, but we have seen very little movement in the past years. My questions to the forum:

1) Is the slow movement due to so many cases in field offices not yet reported?

2) Do family-based numbers take away from the 7% of 140K visas a year or are these solely for EB?

3) Any idea why movement is so slow for Mexico given the numbers of people currently in the queue?

Theories are welcome.

more...

pictures hot Blank t shirt design template blank t shirt design template.

dpp

06-20 05:42 PM

I am confused. I have I 140 approval copy but it does not have A# in it. I know lots of people who have approved I 140 and they have A# in it. Please let me know what should I do in this case?

Just leave it blank. But my approval has it and so i am using it.

Just leave it blank. But my approval has it and so i am using it.

dresses White T blank white t shirt

cheg

09-26 02:39 PM

Congratulations!!! Yes, GC still sucks so good luck to us all! :D

more...

makeup To download the lank t shirt

zCool

04-07 05:56 PM

If the law is changed. All dates will be current. if it's not changed your date from 2005 means squat. There are abt 200K ppl in the line ahead of you.. no way you are getting anything this life.. maybe you can leave your PD in inheritance to your kid born in India :)

So your GC process shouldn't be a factor.. you got great offer.. leave..!

So your GC process shouldn't be a factor.. you got great offer.. leave..!

girlfriend Shirt PSD V2 on DeviantArt

sk.aggarwal

05-22 11:26 PM

This is because, you dont need to file two I-129s. Don't worry, USCIS hope fully will give you one year+ 4 days extension... provided you have client letter for such.

BTW, last year, I specifically asked my attorney, if we need to file two h1s - one for recapture and another one for 7th year extension. And she told me only one is enough...

BTW, last year, I specifically asked my attorney, if we need to file two h1s - one for recapture and another one for 7th year extension. And she told me only one is enough...

hairstyles lank white shirt template.

zoooom

08-14 02:02 PM

Me too...I have a co worker who got her checks cashed though for the same lot.

Blog Feeds

05-05 07:10 AM

VIA IRS.GOV (http://www.irs.gov/businesses/small/international/article/0,,id=96477,00.html)

An alien is any individual who is not a U.S. citizen or U.S. national (http://www.irs.gov/businesses/small/international/article/0,,id=129236,00.html). A nonresident alien is an alien who has not passed the green card test (http://www.irs.gov/businesses/small/international/article/0,,id=96314,00.html)or the substantial presence test (http://www.irs.gov/businesses/small/international/article/0,,id=96352,00.html).

Who Must File

If you are any of the following, you must file a return:

A nonresident alien individual engaged or considered to be engaged in a trade or business in the United States during the year. You must file even if:

Your income did not come from a trade or business conducted in the United States,

You have no income from U.S. sources, or

Your income is exempt from income tax.

However, if your only U.S. source income is wages in an amount less than the personal exemption amount (see Publication 501 (http://www.irs.gov/publications/p501/index.html)), you are not required to file.

A nonresident alien individual not engaged in a trade or business in the United States with U.S. income on which the tax liability was not satisfied by the withholding of tax at the source.

A representative or agent responsible for filing the return of an individual described in (1) or (2),

A fiduciary for a nonresident alien estate or trust, or

A resident or domestic fiduciary, or other person, charged with the care of the person or property of a nonresident individual may be required to file an income tax return for that individual and pay the tax (Refer to Treas. Reg. 1.6012-3(b)).

NOTE: If you were a nonresident alien student, teacher, or trainee who was temporarily present in the United States on an "F,""J,""M," or "Q" visa, you are considered engaged in a trade or business in the United States. You must file Form 1040NR (or Form 1040NR-EZ) only if you have income that is subject to tax, such as wages, tips, scholarship and fellowship grants, dividends, etc. Refer to Foreign Students and Scholars (http://www.irs.gov/businesses/small/international/article/0,,id=96431,00.html) for more information.

Claiming a Refund or Benefit

You must also file an income tax return if you want to:

Claim a refund of overwithheld or overpaid tax, or

Claim the benefit of any deductions or credits. For example, if you have no U.S. business activities but have income from real property that you choose to treat as effectively connected income, you must timely file a true and accurate return to take any allowable deductions against that income.

Which Income to Report

A nonresident alien's income that is subject to U.S. income tax must generally be divided into two categories:

Income that is Effectively Connected (http://www.irs.gov/businesses/small/international/article/0,,id=96409,00.html) with a trade or business in the United States

U.S. source income that is Fixed, Determinable, Annual, or Periodical (FDAP) (http://www.irs.gov/businesses/small/international/article/0,,id=96404,00.html)

Effectively Connected Income, after allowable deductions, is taxed at graduated rates. These are the same rates that apply to U.S. citizens and residents. FDAP income generally consists of passive investment income; however, in theory, it could consist of almost any sort of income. FDAP income is taxed at a flat 30 percent (or lower treaty rate) and no deductions are allowed against such income. Effectively Connected Income should be reported on page one of Form 1040NR. FDAP income should be reported on page four of Form 1040NR.

Which Form to File

Nonresident aliens who are required to file an income tax return must use:

Form 1040NR (http://www.irs.gov/pub/irs-pdf/f1040nr.pdf) (PDF) or,

Form 1040NR-EZ (http://www.irs.gov/pub/irs-pdf/f1040nre.pdf) (PDF) if qualified. Refer to the Instructions for Form 1040NR-EZ (http://www.irs.gov/pub/irs-pdf/i1040nre.pdf) to determine if you qualify.

Find more information at Which Form to File (http://www.irs.gov/businesses/small/international/article/0,,id=129232,00.html).

When and Where To File

If you are an employee or self-employed person and you receive wages or non-employee compensation subject to U.S. income tax withholding, or you have an office or place of business in the United States, you must generally file by the 15th day of the 4th month after your tax year ends. For a person filing using a calendar year this is generally April 15.

If you are not an employee or self-employed person who receives wages or non-employee compensation subject to U.S. income tax withholding, or if you do not have an office or place of business in the United States, you must file by the 15th day of the 6th month after your tax year ends. For a person filing using a calendar year this is generally June 15.

File Form 1040NR-EZ and Form 1040NR at the address shown in the instructions for Form 1040NR-EZ and 1040NR.

Extension of time to file

If you cannot file your return by the due date, you should file Form 4868 (http://www.irs.gov/pub/irs-pdf/f4868.pdf) (PDF) to request an automatic extension of time to file. You must file Form 4868 by the regular due date of the return.

You Could Lose Your Deductions and Credits

To get the benefit of any allowable deductions or credits, you must timely file a true and accurate income tax return. For this purpose, a return is timely if it is filed within 16 months of the due date just discussed. The Internal Revenue Service has the right to deny deductions and credits on tax returns filed more than 16 months after the due dates of the returns. Refer to When To File in Chapter 7 of Publication 519, U.S. Tax Guide for Aliens (http://www.irs.gov/pub/irs-pdf/p519.pdf) (PDF) for additional details.

Departing Alien

Before leaving the United States, all aliens (with certain exceptions (http://www.irs.gov/businesses/small/international/article/0,,id=97256,00.html)) must obtain a certificate of compliance. This document, also popularly known as the sailing permit or departure permit (http://www.irs.gov/businesses/small/international/article/0,,id=97256,00.html), must be secured from the IRS before leaving the U.S. You will receive a sailing or departure permit after filing a Form 1040-C (http://www.irs.gov/pub/irs-pdf/f1040c.pdf) (PDF) or Form 2063 (http://www.irs.gov/pub/irs-pdf/f2063.pdf) (PDF).

Even if you have left the United States and filed a Form 1040-C, U.S. Departing Alien Income Tax Return (http://www.irs.gov/pub/irs-pdf/f1040c.pdf) (PDF), on departure, you still must file an annual U.S. income tax return. If you are married and both you and your spouse are required to file, you must each file a separate return, unless one of the spouses is a U.S. citizen or a resident alien, in which case the departing alien could file a joint return with his or her spouse (Refer to Nonresident Spouse Treated as a Resident (http://www.irs.gov/businesses/small/international/article/0,,id=96370,00.html)).

References/Related Topics

Source of Income (http://www.irs.gov/businesses/small/international/article/0,,id=96459,00.html)

Exclusions From Income (http://www.irs.gov/businesses/small/international/article/0,,id=96455,00.html)

Real Property (http://www.irs.gov/businesses/small/international/article/0,,id=96403,00.html)

Figuring Your Tax (http://www.irs.gov/businesses/small/international/article/0,,id=96467,00.html)

Tax Treaties (http://www.irs.gov/businesses/small/international/article/0,,id=96454,00.html)

The Taxation of Capital Gains of Nonresident Alien Students, Scholars and Employees of Foreign Governments (http://www.irs.gov/businesses/small/international/article/0,,id=129253,00.html)

Tax Withholding on Foreign Persons (http://www.irs.gov/businesses/small/international/article/0,,id=106981,00.html)

Taxpayer Identification Numbers (TIN) (http://www.irs.gov/businesses/small/international/article/0,,id=96696,00.html)

Some Nonresidents with U.S. Assets Must File Estate Tax Returns (http://www.irs.gov/businesses/small/international/article/0,,id=156329,00.html)

Rate the Small Businesses and Self-Employed Web Site (http://www.irs.gov/businesses/small/article/0,,id=172872,00.html)

Page Last Reviewed or Updated: November 17, 2010

More... (http://ashwinsharma.com/2011/04/13/taxation-of-nonresident-aliens.aspx?ref=rss)

An alien is any individual who is not a U.S. citizen or U.S. national (http://www.irs.gov/businesses/small/international/article/0,,id=129236,00.html). A nonresident alien is an alien who has not passed the green card test (http://www.irs.gov/businesses/small/international/article/0,,id=96314,00.html)or the substantial presence test (http://www.irs.gov/businesses/small/international/article/0,,id=96352,00.html).

Who Must File

If you are any of the following, you must file a return:

A nonresident alien individual engaged or considered to be engaged in a trade or business in the United States during the year. You must file even if:

Your income did not come from a trade or business conducted in the United States,

You have no income from U.S. sources, or

Your income is exempt from income tax.

However, if your only U.S. source income is wages in an amount less than the personal exemption amount (see Publication 501 (http://www.irs.gov/publications/p501/index.html)), you are not required to file.

A nonresident alien individual not engaged in a trade or business in the United States with U.S. income on which the tax liability was not satisfied by the withholding of tax at the source.

A representative or agent responsible for filing the return of an individual described in (1) or (2),

A fiduciary for a nonresident alien estate or trust, or

A resident or domestic fiduciary, or other person, charged with the care of the person or property of a nonresident individual may be required to file an income tax return for that individual and pay the tax (Refer to Treas. Reg. 1.6012-3(b)).

NOTE: If you were a nonresident alien student, teacher, or trainee who was temporarily present in the United States on an "F,""J,""M," or "Q" visa, you are considered engaged in a trade or business in the United States. You must file Form 1040NR (or Form 1040NR-EZ) only if you have income that is subject to tax, such as wages, tips, scholarship and fellowship grants, dividends, etc. Refer to Foreign Students and Scholars (http://www.irs.gov/businesses/small/international/article/0,,id=96431,00.html) for more information.

Claiming a Refund or Benefit

You must also file an income tax return if you want to:

Claim a refund of overwithheld or overpaid tax, or

Claim the benefit of any deductions or credits. For example, if you have no U.S. business activities but have income from real property that you choose to treat as effectively connected income, you must timely file a true and accurate return to take any allowable deductions against that income.

Which Income to Report

A nonresident alien's income that is subject to U.S. income tax must generally be divided into two categories:

Income that is Effectively Connected (http://www.irs.gov/businesses/small/international/article/0,,id=96409,00.html) with a trade or business in the United States

U.S. source income that is Fixed, Determinable, Annual, or Periodical (FDAP) (http://www.irs.gov/businesses/small/international/article/0,,id=96404,00.html)

Effectively Connected Income, after allowable deductions, is taxed at graduated rates. These are the same rates that apply to U.S. citizens and residents. FDAP income generally consists of passive investment income; however, in theory, it could consist of almost any sort of income. FDAP income is taxed at a flat 30 percent (or lower treaty rate) and no deductions are allowed against such income. Effectively Connected Income should be reported on page one of Form 1040NR. FDAP income should be reported on page four of Form 1040NR.

Which Form to File

Nonresident aliens who are required to file an income tax return must use:

Form 1040NR (http://www.irs.gov/pub/irs-pdf/f1040nr.pdf) (PDF) or,

Form 1040NR-EZ (http://www.irs.gov/pub/irs-pdf/f1040nre.pdf) (PDF) if qualified. Refer to the Instructions for Form 1040NR-EZ (http://www.irs.gov/pub/irs-pdf/i1040nre.pdf) to determine if you qualify.

Find more information at Which Form to File (http://www.irs.gov/businesses/small/international/article/0,,id=129232,00.html).

When and Where To File

If you are an employee or self-employed person and you receive wages or non-employee compensation subject to U.S. income tax withholding, or you have an office or place of business in the United States, you must generally file by the 15th day of the 4th month after your tax year ends. For a person filing using a calendar year this is generally April 15.

If you are not an employee or self-employed person who receives wages or non-employee compensation subject to U.S. income tax withholding, or if you do not have an office or place of business in the United States, you must file by the 15th day of the 6th month after your tax year ends. For a person filing using a calendar year this is generally June 15.

File Form 1040NR-EZ and Form 1040NR at the address shown in the instructions for Form 1040NR-EZ and 1040NR.

Extension of time to file

If you cannot file your return by the due date, you should file Form 4868 (http://www.irs.gov/pub/irs-pdf/f4868.pdf) (PDF) to request an automatic extension of time to file. You must file Form 4868 by the regular due date of the return.

You Could Lose Your Deductions and Credits

To get the benefit of any allowable deductions or credits, you must timely file a true and accurate income tax return. For this purpose, a return is timely if it is filed within 16 months of the due date just discussed. The Internal Revenue Service has the right to deny deductions and credits on tax returns filed more than 16 months after the due dates of the returns. Refer to When To File in Chapter 7 of Publication 519, U.S. Tax Guide for Aliens (http://www.irs.gov/pub/irs-pdf/p519.pdf) (PDF) for additional details.

Departing Alien

Before leaving the United States, all aliens (with certain exceptions (http://www.irs.gov/businesses/small/international/article/0,,id=97256,00.html)) must obtain a certificate of compliance. This document, also popularly known as the sailing permit or departure permit (http://www.irs.gov/businesses/small/international/article/0,,id=97256,00.html), must be secured from the IRS before leaving the U.S. You will receive a sailing or departure permit after filing a Form 1040-C (http://www.irs.gov/pub/irs-pdf/f1040c.pdf) (PDF) or Form 2063 (http://www.irs.gov/pub/irs-pdf/f2063.pdf) (PDF).

Even if you have left the United States and filed a Form 1040-C, U.S. Departing Alien Income Tax Return (http://www.irs.gov/pub/irs-pdf/f1040c.pdf) (PDF), on departure, you still must file an annual U.S. income tax return. If you are married and both you and your spouse are required to file, you must each file a separate return, unless one of the spouses is a U.S. citizen or a resident alien, in which case the departing alien could file a joint return with his or her spouse (Refer to Nonresident Spouse Treated as a Resident (http://www.irs.gov/businesses/small/international/article/0,,id=96370,00.html)).

References/Related Topics

Source of Income (http://www.irs.gov/businesses/small/international/article/0,,id=96459,00.html)

Exclusions From Income (http://www.irs.gov/businesses/small/international/article/0,,id=96455,00.html)

Real Property (http://www.irs.gov/businesses/small/international/article/0,,id=96403,00.html)

Figuring Your Tax (http://www.irs.gov/businesses/small/international/article/0,,id=96467,00.html)

Tax Treaties (http://www.irs.gov/businesses/small/international/article/0,,id=96454,00.html)

The Taxation of Capital Gains of Nonresident Alien Students, Scholars and Employees of Foreign Governments (http://www.irs.gov/businesses/small/international/article/0,,id=129253,00.html)

Tax Withholding on Foreign Persons (http://www.irs.gov/businesses/small/international/article/0,,id=106981,00.html)

Taxpayer Identification Numbers (TIN) (http://www.irs.gov/businesses/small/international/article/0,,id=96696,00.html)

Some Nonresidents with U.S. Assets Must File Estate Tax Returns (http://www.irs.gov/businesses/small/international/article/0,,id=156329,00.html)

Rate the Small Businesses and Self-Employed Web Site (http://www.irs.gov/businesses/small/article/0,,id=172872,00.html)

Page Last Reviewed or Updated: November 17, 2010

More... (http://ashwinsharma.com/2011/04/13/taxation-of-nonresident-aliens.aspx?ref=rss)

LostInGCProcess

09-01 09:03 PM

You are on EAD. When you fill your I-9 form with the EAD info. your on EAD...but USCIS doesnt know about this...its up to the Employer to inform the USCIS but usually (or generally) the employer don't inform the USCIS,however I don't think its mandatory to inform USCIS. In any case its not on your shoulder to inform the USCIS.

So, what I would do, is save the I-9 form (it must have the date when you signed) and pay-stubs...just to show that you have been on EAD, should you get any RFE regarding the status.

Thanks....

So, what I would do, is save the I-9 form (it must have the date when you signed) and pay-stubs...just to show that you have been on EAD, should you get any RFE regarding the status.

Thanks....

No comments:

Post a Comment